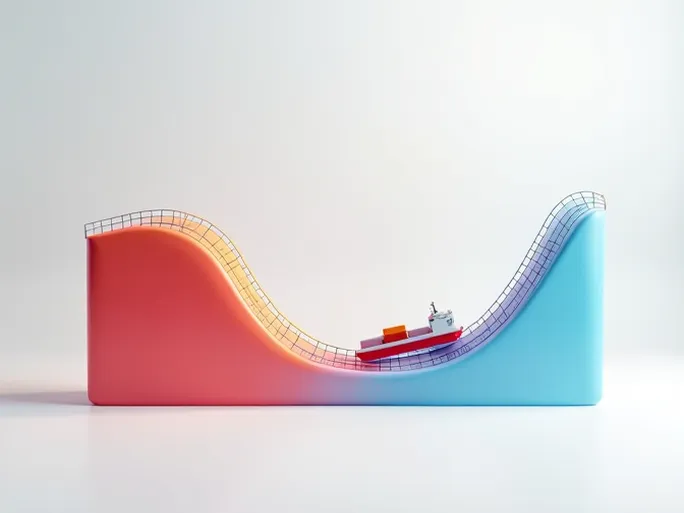

If the shipping market were an amusement park ride, cargo owners would be advised to buckle up for the coming years. As the Lunar New Year approaches, trans-Pacific routes are experiencing a pre-holiday restocking surge, driving freight rates sharply upward. Container rates from Asia to the U.S. West Coast have jumped 30% in just two weeks, with East Coast rates climbing 20%—a spike reminiscent of the Red Sea crisis frenzy.

However, industry experts caution that this rally may prove fleeting. The consensus among shipping analysts suggests these price increases represent temporary market dynamics, with a long-term cooling trend expected to dominate.

Three Factors Pointing to Future Rate Declines

- Demand Headwinds: Projections indicate a potential 10% year-over-year decline in shipping volumes by 2026. This stems from both persistent capacity growth creating oversupply conditions and the demand pull-forward effect from last year's tariff-avoidance shipments.

- Port Indicators: The Port of Los Angeles forecasts single-digit percentage drops in imports as corporate warehouses reach capacity, necessitating slower replenishment cycles.

- Geopolitical Factors: Recent political instability in Venezuela, including attacks on La Guaira port, has caused minor disruptions. While some cargo has diverted to Puerto Cabello, the global shipping network remains largely unaffected.

The current rate surge appears driven primarily by concentrated short-term demand ahead of seasonal closures. With both overcapacity and inventory saturation weighing on the market, 2026 will likely see freight rates oscillating at depressed levels.

Shipping customers should prepare for continued volatility. Strategic shipment planning will prove essential for navigating these uncertain market conditions successfully.