Uschina Trade War Escalates Tariffs Threaten Shipbuilding Sector

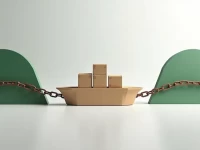

The US is escalating countermeasures against China's shipbuilding industry, including adjusting vessel service fees, potentially lifting LNG export restrictions, and imposing tariffs. China retaliated by levying fees on US-flagged vessels. This stems from US concerns about China's 'unfair' shipbuilding practices, aiming to protect its domestic industry. The escalating trade friction will likely increase shipping costs and potentially trigger global trade tensions, requiring shipping companies to adapt flexibly. The situation highlights the growing economic competition and potential disruptions within the global maritime sector.